- What is the Exness Investment Calculator?

- Using the Exness Investment Calculator

- Interpreting the Results from the Exness Investment Calculator

- Example of Using Exness Calculator

- Key Features of the Exness Calculator

- Exness Calculator vs. Traditional Methods

- Integrating the Calculator into Your Investment Strategy

- Conclusion

- Frequently Asked Questions

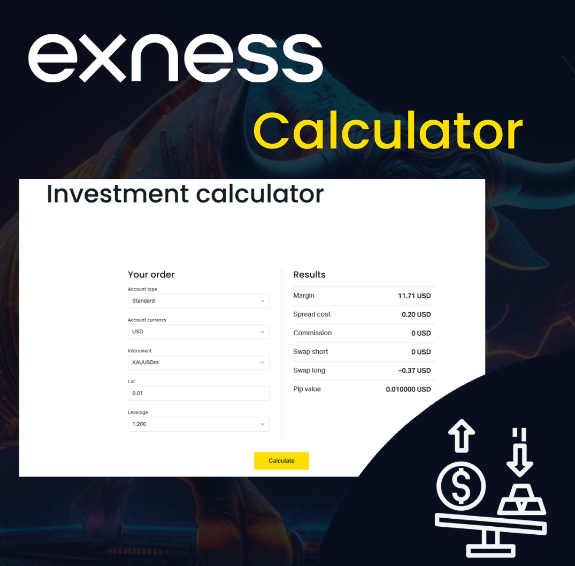

What is the Exness Investment Calculator?

It is a tool that allows you to determine the profits and returns of your investments. This special tool, accessible on the Exness platform, actually enables traders to simulate several various trading decisions and get an insight of possible outcomes, before actually executing the order for real. It’s a Priceless tool for creating trading strategies, investment asset allocation, and risk management to make most out of the each of the transaction.

Key Components:

Profit Calculator:

- Function: Helps traders estimate the potential profit or loss of a trade based on several variables including entry and exit prices, trade size, and currency pair.

- Usage: Enter the buy and sell prices along with the amount of units traded to receive an instant calculation of potential profit or loss, factoring in spreads and any applicable fees.

Forex Calculator:

- Function: Provides calculations related to currency trading, including conversions and required margin. This calculator is invaluable for forex traders looking to understand the financial implications of their trading decisions.

- Usage: Input the currency pair, account currency, trade size (in lots), and leverage to see required margin, pip value, and potential profit or loss.

Leverage Calculator:

- Function: Allows traders to understand the effects of leverage on their trades. Leverage can amplify both gains and losses, making it essential to calculate it precisely.

- Usage: Input the amount of capital invested, the leverage ratio, and the value of the position to calculate the total exposure and the required margin.

Trading Calculator:

- Function: Combines elements of the profit, forex, and leverage calculators to provide a comprehensive overview of a planned trade’s financial metrics.

- Usage: Fill in details such as instrument type, price levels, lot size, and leverage to get detailed information on margins, pip value, swap fees, and potential returns or losses.

Advantages:

- Risk Management: Enables precise calculation of risk per trade, helping to maintain risk exposure within acceptable limits.

- Strategy Planning: Assists in the meticulous planning of entry and exit points, expected returns, and stop-loss orders.

- Financial Optimization: Allows traders to use leverage more effectively, balancing the potential for higher returns against the risk of larger losses.

How to Access:

- The Exness Investment Calculator can be accessed directly from the Exness website under the tools or resources section. Users simply need to log into their Exness account to utilize this feature, ensuring all calculations are tailored to their specific trading conditions and account settings.

The Exness Investment Calculator is a very powerful tool which assists traders with having an idea of what to expect plus it presents them with financial information regarding possible trade. Albeit it could be very useful as it helps to make maximum return, reduce risk and change strategy, but still it is as well recommended for client to actually do his own analysis prior to make a decision if possible. Whether you are a sweeping forex trader or a newbie to the markets, it is indeed a fact that the investment calculator is a primary tool that will help you manage your trading portfolio more adequately.

Using the Exness Investment Calculator

The Exness Investment Calculator is a valuable tool for traders to analyze potential trades and optimize their strategy. Here’s how to effectively use the calculator by navigating through its different functions:

Selecting Account Type and Trading Instrument

1. Choose Account Type:

- Procedure: When you open the Exness Investment Calculator, start by selecting the type of trading account you have with Exness, such as Standard, Pro, or ECN. This is important as different account types have varying conditions like spreads, leverage options, and commission rates which can affect the calculation results.

- Impact: Each account type offers unique trading conditions that can influence the profitability and risk level of your trades.

2. Select Trading Instrument:

- Procedure: Choose the trading instrument you wish to trade. Exness offers a wide range, including forex pairs, commodities, indices, and cryptocurrencies.

- Impact: Different instruments have different trading characteristics, such as volatility and liquidity, which are critical for calculating potential profits and managing risks.

Inputting Position Size, Entry Price, and Leverage

1. Position Size:

- Procedure: Enter the size of your position, which is typically measured in lots or units depending on the instrument. The position size directly affects both the potential return and the risk of the trade.

- Impact: Larger positions increase both the potential profit and the potential risk. It’s crucial to balance the position size with your overall risk management strategy.

2. Entry Price:

- Procedure: Input the entry price at which you plan to enter the trade. This price should be based on your market analysis and trading strategy.

- Impact: The entry price helps determine the initial cost of the trade and is essential for calculating potential profit or loss based on target and stop-loss levels.

3. Leverage:

- Procedure: Select the amount of leverage you wish to apply to your trade. Leverage can significantly increase your exposure without requiring a proportional increase in your capital investment.

- Impact: While leverage can magnify returns, it also increases risk. It’s important to use leverage wisely, considering both the opportunities and the threats it poses.

Choosing Account Currency

Procedure:

- Choose the currency in which your trading account is denominated. This setting ensures that the calculator’s output reflects the actual monetary values you will see in your trading account for profits and losses.

Impact:

- Selecting the correct account currency is vital for accurate calculations of profit, loss, and required margin. Currency conversion rates can affect these calculations if your account currency differs from the currency pair you are trading.

Using the Exness Investment Calculator allows you to thoroughly plan each trade by considering various financial metrics and trading conditions. By meticulously inputting details such as account type, trading instrument, position size, entry price, leverage, and account currency, you can gain a comprehensive overview of potential outcomes. This process not only aids in maximizing potential returns but also enhances your ability to manage associated risks effectively.

Interpreting the Results from the Exness Investment Calculator

When using the Exness Investment Calculator, understanding the output is crucial for making informed trading decisions. Here’s how to interpret key aspects of the results:

Margin Requirements and Leverage Impact

Margin Requirements:

- Explanation: This is the amount of capital required to open and maintain your position. It is calculated based on the leverage you’ve chosen and the total value of the position.

- Interpretation: Higher leverage reduces the margin requirement, allowing you to open larger positions with less capital. However, this also increases the risk as it magnifies both potential profits and losses. A lower margin requirement means higher leverage is being used.

Spread Cost and Commissions

Spread Cost:

- Explanation: The spread is the difference between the bid and ask price of the trading instrument. It represents the cost paid each time a position is opened.

- Interpretation: The calculator will show how much the spread costs based on the position size. Lower spreads generally mean lower trading costs, which is critical for strategies like scalping where multiple trades are made in a session.

Commissions:

- Explanation: Some account types or instruments may include a commission per trade. This fee is charged by the broker for executing trades.

- Interpretation: Understanding the commission structure is important as it impacts the overall cost of trading. High commissions can eat into profits, especially for high-volume traders.

Swaps and Position Holding Costs

Swaps:

- Explanation: Swap fees or overnight interest is charged when a position is held open overnight. The rate depends on the differential between the interest rates of the traded currencies.

- Interpretation: The calculator will provide an estimate of swap costs based on current rates. Traders need to consider these costs when planning to hold positions overnight or longer, as they can affect profitability.

Pip Value for the Selected Instrument

Pip Value:

- Explanation: Pip value indicates how much a one-pip movement in the exchange rate affects the monetary value of the position.

- Interpretation: This is crucial for understanding potential profit or loss from price movements. The calculator shows the pip value which helps in setting precise risk management measures, such as stop-loss orders. Pip value varies with the currency pair, the size of the trade, and the currency in which the account is denominated.

The Exness Investment Calculator provides comprehensive results that help traders make more informed decisions. By accurately interpreting the implications of margin requirements, leverage, spread costs, commissions, swap rates, and pip values, traders can better manage their risks and optimize their trading strategies. Each of these elements plays a crucial role in the financial outcomes of trades, and understanding them is essential for achieving trading success.

Example of Using Exness Calculator

To illustrate how to use the Exness Investment Calculator effectively, let’s consider an example scenario:

Scenario:

A trader wants to calculate potential profits and the required margin for a forex trade on the EUR/USD pair.

- Account Type: Standard

- Trading Instrument: EUR/USD

- Account Currency: USD

- Position Size: 1 lot (100,000 units)

- Entry Price: 1.1800

- Exit Price: 1.1850

- Leverage: 1:100

Steps to Use the Calculator:

- Select the Account Type: Choose ‘Standard’ from the dropdown menu.

- Input Trading Instrument: Type in or select ‘EUR/USD’ from the list.

- Set the Account Currency: Ensure ‘USD’ is selected.

- Enter the Position Size: Input ‘1 lot’ equivalent to 100,000 units of the base currency.

- Provide Entry and Exit Prices: Enter ‘1.1800’ for the entry price and ‘1.1850’ for the exit price.

- Choose Leverage: Select ‘1:100’ from the leverage options.

Results:

- Profit/Loss: The calculator will compute the profit or loss based on the entry and exit prices. For this scenario, the trader stands to gain from the 50 pip increase in the EUR/USD pair.

- Required Margin: Given the leverage of 1:100, the required margin will also be calculated to show how much capital is needed to open the trade.

- Pip Value: The calculator will provide the value of each pip movement, which in this case is crucial for determining the exact profit from the 50 pip rise.

Key Features of the Exness Calculator

Understanding Potential Profits and Risks

- Profit Calculations: The calculator allows traders to input hypothetical entry and exit points for a trade to see the potential profit or loss. This helps in planning trades more effectively and setting realistic profit targets.

- Risk Assessment: It also calculates the required margin based on the leverage used, which helps traders understand the amount of capital at risk and manage their trading capital more efficiently.

Customizable Investment Scenarios

- Versatility in Parameters: Traders are colleagues to partition different components like leverage, positioning size and stop-loss and take-profit modalities to discover how these parameters affect probable results.

- Scenario Analysis: Specially, this is used to think about a bear market to find the most rational trading strategy for a particular situation. Investors can react at the “what-if” on the market conditions and trading decisions without money losses.

Integral for traders at Exness Investment Calculator is advertising how profitable changes could be individually, and they might have a holistic comprehension. The calculator enables traders by presenting comprehensive profits analysis, risks identification, and margins required for a trade and hence traders get to do informed decision, plan their trades strategically and manage their finances well. This tool equalizes the traders equipping them with the ability to test and experience the effect of various trading scenarios and redesign their plans based on the calculations and facts.

Exness Calculator vs. Traditional Methods

Comparing the Exness Investment Calculator to traditional methods of calculating trading metrics illuminates its advantages and efficiencies in modern trading environments.

1. Speed and Efficiency:

- Exness Calculator: Provides instant calculations for profit, loss, margin requirements, and more with just a few inputs. This is significantly faster than traditional methods, which often require manual calculation or the use of separate, less integrated tools.

- Traditional Methods: Typically involve using spreadsheets or basic financial calculators. These methods can be time-consuming and prone to human error, especially under the pressure of active trading.

2. Accuracy:

- Exness Calculator: Automatically takes into account current market conditions, exact leverage settings, and precise instrument specifications. This integration reduces the likelihood of mistakes and ensures high accuracy in calculations.

- Traditional Methods: Depending on the trader’s familiarity with financial formulas and market specifics, the risk of miscalculations can be higher, potentially leading to costly trading decisions.

3. Accessibility:

- Exness Calculator: Accessible directly through the web with no need for downloads or specific hardware, allowing traders to make calculations from anywhere at any time.

- Traditional Methods: Often require access to detailed financial tables, spreadsheets, or desktop financial software, which may not be as readily available or convenient for on-the-go calculations.

4. Comprehensive Analysis:

- Exness Calculator: Integrates various financial calculations into one tool, offering a comprehensive overview of potential trade outcomes, including profits, risks, margin implications, and more.

- Traditional Methods: Generally, separate tools or calculations are needed to analyze different aspects of trades, which can compartmentalize information and make holistic trade assessment more challenging.

Integrating the Calculator into Your Investment Strategy

Incorporating the Exness Investment Calculator into your trading strategy can enhance decision-making processes and risk management. Here’s how you can integrate it effectively:

1. Pre-Trade Analysis:

- Use the calculator to assess potential profit and risk before entering a trade. Input different scenarios to understand how variations in market price, leverage, or position size could affect the outcome. This can help in setting more accurate entry and exit points, as well as appropriate stop-loss and take-profit orders.

2. Risk Management:

- Regularly use the calculator to determine the appropriate amount of leverage and margin for your trades, ensuring that you are not overexposed in any single position. This is crucial in adhering to sound risk management principles and protecting your capital.

3. Performance Review:

- After closing trades, use the calculator to compare expected results with actual outcomes. This analysis can provide insights into the accuracy of your market predictions and the effectiveness of your trading strategy.

4. Strategic Adjustments:

- Based on the insights gained from the calculator, adjust your trading strategies and parameters. For instance, if you find that your risk levels are consistently too high, you might opt to decrease your leverage or reduce your position sizes.

5. Educational Tool:

- Especially for newer traders, the calculator serves as an educational tool to better understand the financial mechanics of trading, such as how different factors like price changes, leverage, and market conditions interact to affect trade profitability.

Conclusion

The Exness Investment Calculator is a superior tool compared to traditional methods, offering speed, efficiency, accuracy, and accessibility. By integrating this calculator into your investment strategy, you can make more informed decisions, manage risks effectively, and potentially enhance your trading performance. This tool not only supports operational efficiencies but also contributes to strategic trading growth and financial knowledge.

Frequently Asked Questions

What is the best leverage for a $10 account on Exness?

For a $10 account on Exness, it’s advisable to use lower leverage to minimize risk, especially if you are a beginner. While Exness offers leverage up to 1:2000, using a more conservative leverage like 1:100 or 1:200 may help manage risk better. High leverage can magnify both profits and losses, but with a small account, the goal should be to preserve capital and learn.